Saving money tips for college students are essential to managing financial challenges during one of the most exciting phases of life. Although college offers a wealth of new experiences and opportunities, it also sometimes involves huge financial obligations. It takes smart tactics to strike a balance between personal spending and academic obligations. We’ll look at practical strategies in this extensive guide to help college students maximise their time in school while saving money.

Why Saving Money Is Important for College Students

Before we go into the tips, let’s first grasp why conserving money is so important:

Reduce Stress: Financial stability reduces stress, allowing you to focus on your studies and personal development.

Avoid Debt: Effective money management can reduce the need for loans or credit card debt.

Create Good Habits: College is an excellent opportunity to learn lifelong financial skills.

Prepare for the Future: Savings can help with post-graduation goals like as furthering your education, travelling, or establishing a new career.

1. Make a budget and stick to it

Budgeting is the basis of financial management. Begin by detailing your income and expenses to better understand where your money goes.

How to Create a College Budget: Identify income sources, such as part-time work, allowances, scholarships, and financial help.

Track Expenses: Separate spending into fixed (tuition, rent) and variable (entertainment, food) categories.

Set spending limits by allocating specified amounts to each category and prioritising essentials.

Use Budgeting Tools: Apps like as Mint, PocketGuard, and YNAB (You Need a Budget) can make tracking and budgeting easier.

Pro Tip: Review your budget on a regular basis to account for any changes in income or expenses.

2. Take advantage of student discounts

College students get discounts on a variety of items and services. To maximise savings, always bring your student ID.

Where to Find Students Discounts?

Technology: Save money on software, laptops, and accessories from manufacturers like Apple, Microsoft, and Adobe.

Transportation: Many public transportation networks and ride-sharing applications provide student discounts.

Entertainment: Spotify, Hulu, and Amazon Prime all offer student options.

Food: Restaurants and coffee shops near schools frequently offer discounts.

Clothing businesses and online marketplaces such as UNiDAYS provide exclusive bargains for students.

Pro Tip: Before making any purchases, look online for student discounts.

3. Cook at home and eat out less

Food is one of the most costly expenses for college students. Cooking at home is a healthier and more cost-effective alternative than eating out frequently.

How to Save on Food?

Meal Planning: Plan your weekly meals to avoid impulse purchases and waste. Purchase non-perishable things in bulk, such as rice, pasta, and canned goods, to save money.

Use Coupons: Search for grocery shop coupons and offers on apps and websites.

Share with your roommates: Split the cost of shopping and cook together to save time and money.

Invest in a slow cooker: This inexpensive equipment can help you produce substantial, low-cost meals.

Pro Tip: To prevent wasting money on campus vending machines or cafes, pack lunch and snacks.

4. Take public transportation or walk.

Transportation expenditures can easily add up, especially if you use taxis or ride shares. Using public transit or walking is an excellent method to save money.

Transportation Tips

Purchase Monthly Passes: If you use public transport regularly, a monthly pass is more cost-effective than daily tickets.

Bike to Campus: Invest in a bicycle to save money on petrol or public transportation while remaining active.

Carpool: Share trips with classmates to reduce gasoline and parking costs.

Avoid Parking Fees: If you drive, look for free or low-cost parking spots.

Pro tip: Many universities have complimentary shuttle services; take advantage of them!

5. Shop Smart for Textbooks.

Textbooks can be a major cost each semester. With any work, you can save hundreds of dollars.

Textbook Saving Tips

Buy used books via online marketplaces such as Chegg, Amazon, or campus bookshops.

Rent Textbooks: Renting is often less expensive than buying, particularly for one-time use books.

Go Digital: E-books and online resources are usually less priced than print ones.

Sell Back: At the end of the semester, sell your outdated textbooks to reclaim some of the expense.

Use Libraries: Borrow books from campus or local libraries whenever possible.

Pro tip: Before making a purchase, compare pricing across multiple platforms.

6. Avoid credit card debt

Credit cards might be convenient, but they can also lead to financial problems if not utilised responsibly. Limit your credit card usage and pay off any outstanding balances as soon as possible.

Tips For Responsible Credit Card Use

To avoid interest costs, pay off your balance every month.

Keep track of your credit card transactions to stay within budget.

Use credit cards for emergencies rather than daily spending.

Choose Student-Friendly Cards: Look for cards that provide cheap fees and student perks.

Pro Tip: Avoid using numerous credit cards to reduce the temptation to overspend.

7. Find Part-Time Work or Side Jobs.

Earning extra cash is a great way to increase your savings while also acquiring useful professional experience.

Job Ideas for College Students

On-campus jobs include working in the library, cafeteria, or as a teaching assistant.

Freelancing involves providing online services such as writing, graphic design, and tutoring.

Gig Economy: For flexible work, join networks such as Uber Eats, TaskRabbit, and Fiverr.

Internships: Some internships pay stipends or hourly rates while giving career-related experience.

Sell Crafts or Goods: Transform your interests, such as crafting or baking, into a small business.

Pro Tip: To avoid burnout, balance employment and academic duties.

8. Utilise free campus resources

Many institutions provide free or low-cost resources to assist students save money.

Common Campus Resources

Fitness Centres: Use on-campus fitness facilities instead of purchasing a gym membership.

Career Services: We offer free resume critiques, job search aid, and interview preparation.

Health Services: Use campus health centres to get economical medical care.

Entertainment: Attend free events such as movie nights, concerts, or workshops hosted by the college.

Pro Tip: During orientation, become acquainted with all of the services available at your college.

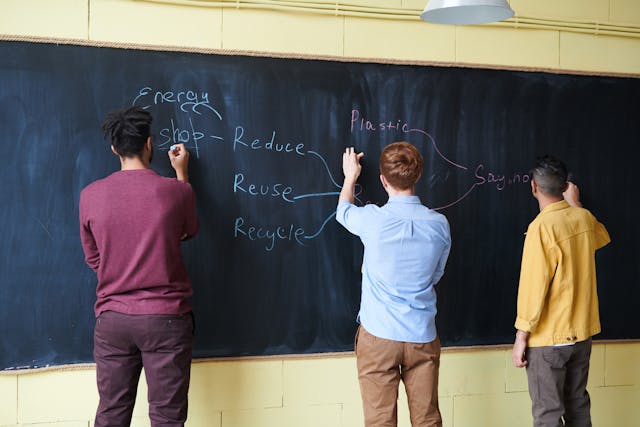

9. Engage in energy conservation

If you live off-campus, lowering your utility expenditures can result in large monthly savings.

Energy Saving Tips

Turn Off Lights: Conserve energy by turning off lights and appliances when not in use.

Use Energy-Efficient Bulbs: LED bulbs use less energy and last longer.

Adjust Thermostats: Adjust the thermostat to a comfortable but energy-efficient temperature.

Unplug Devices: To avoid phantom energy usage, unplug chargers and electronics when not in use.

Pro Tip: Split utility bills with housemates to share expenses.

10. Plan Affordable Entertainment

Have fun without breaking the bank. There are numerous low-cost and free entertainment choices accessible.

Ideas for Budget-Friendly Fun

Host Game Nights: Invite friends over to play board or card games.

Explore Outdoors: Enjoy outdoor activities such as hiking, biking, and picnics at local parks.

Student Activity: Student activities include joining university clubs and attending student events for free entertainment.

Stream Movies: Instead of going to the theatre, use economical streaming services or free trials.

Volunteer: Get involved in community service projects, which can be both gratifying and social.

Pro Tip: Look for “free admission” days at museums or cultural institutions near your college.

11. Create an emergency fund.

An emergency fund gives financial protection and peace of mind in the face of unforeseen circumstances.

Steps to create an emergency fund

Start small: Aim for 10,000 Rs at first, then gradually raise it.

Automate Savings: Create automatic transfers to a designated savings account.

Cut back temporarily: Reduce discretionary expenditure to increase savings.

Use Windfalls Wisely allocate bonuses or gift money to your emergency fund.

Pro Tip: Keep your emergency savings separate from your primary account to prevent unintentional spending.

Final Thoughts

Saving money as a college student may seem difficult at first, but it is possible with the appropriate tactics. Budget intelligently, take advantage of discounts, cut unnecessary spending, and use university services to save money without sacrificing your educational experience.

Remember that every small step matters. Begin applying these strategies today to lay a solid financial foundation for the future.

FAQs

1. How much should a college student save each month?

It depends on your income and costs, but try to save at least 10-20% of your income each month.

2. Can I save money without working?

Yes! To save money even when you don’t have a job, take advantage of student discounts, cook at home, and eliminate unnecessary spending.

3. Which is the greatest budgeting tool for students?

Popular choices include Mint, YNAB, and PocketGuard. Choose one that aligns with your preferences and ambitions.

4. How can I save on rent?

Consider living with roommates, off-campus accommodation, or commuting from home if feasible.

5. Why is it vital to have an emergency fund?

An emergency fund provides financial protection for unexpected events such as medical emergencies or car repairs.

Learn more about creating a college budget in our ultimate budgeting guide for students.